Are You Building Something Users Want, or Just Something?

How my experience with the mobile wallet wars influences how I think about building

Right now, there seems to be a lot of pressure for companies to do something, especially in two areas near and dear to my heart, Fintech & AI.

Almost every company feels like they NEED to do SOMETHING in AI

More industry-specific, banks and fintechs WANT to do SOMETHING with stablecoins

This feels eerily similar to the mobile app rush of 2008, where every company suddenly felt like they had to release a mobile app, leading to some truly horrendous mobile experiences. Even now there are still many terrible examples, something I encounter most often when trying to book travel, which is ironic since it’s an industry built on mobility.

There’s also the mobile wallet rush of 2014 - 2020, which I had a front row seat at during my time at Braintree. Banks and payment networks launched a slew of me-too products as a protectionist measure against the then new kids on the block: Apple and Google Pay, and also to attempt to unseat PayPal.

In their rush to do something, many products were launched that drove little user interest and actually increased checkout friction, which is a big no-no for merchants trying to get users to complete their purchase as quickly as possible.

Doing something because you can is not enough anymore: the bar has been raised, which is great for consumers. The mobile wallets of today are better because of it. That bar applies to AI and stablecoins too. Nowadays, when I talk to prospects about integrating AI functionality into their business, I find it important to recenter them away from the flashy use cases that lack depth and towards proven use cases that deliver value sooner.

The chasm between prototyping a product and launching is an underappreciated challenge, especially given how quickly you can now get to that “80% done” milestone. But especially in areas like Fintech where the unhappy path is often the one that causes financial, reputational and regulatory risk, it’s even more important to get things right.

This might mean starting smaller to test the waters or looking internal first. I personally believe operations is one of (if not) the fastest paths to return on investment in AI today, with the added benefit of being able to explore in a controlled environment without directly impacting users.

It’s often an under-resourced part of the business where small wins can have outsized impacts. You can also safely assume that many internal folks are using AI unofficially anyway leading to no lack of ideas that could be worth exploring.

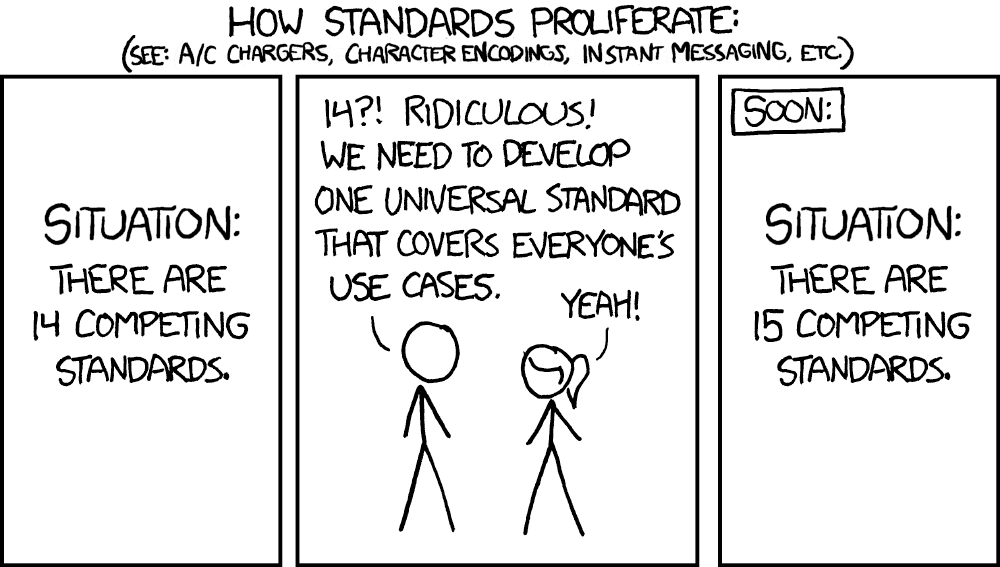

Switching briefly to stablecoins, there are already hundreds of stablecoins out there, and smart folks think there’ll be 1000+ (relevant xkcd comic below). The landscape is set to become more fragmented than prior cycles, though to some, that’s the whole point.

Ultimately users will make their choices in an increasingly crowded field, but for mainstream users who are used to complexity being abstracted away, this will be a challenge in the near term as it’s not just about what you hold, it’s also about what the person on the other side of the transaction is willing to accept based on the perceived risk profile, real world utility and other factors.

In traditional payments, users worry very little about whether their specific bank’s card will work for a transaction. That complexity is mostly abstracted away by Visa or Mastercard, and mainstream users (and merchants) will want that same simplicity for day-to-day payments. There are definitely contenders looking to become that new abstraction layer. It’ll be interesting to watch.

If you’re building in Fintech or AI and want to have a chat, reach out!